How to Do an OPM Case

SUMMARY

If you haven’t yet created a profile on the OPM portal, do so here.

Show the client one or more of the explainer videos (Video 1 $500,000, Video 2)

ONLY IF THEY ARE LIQUIDATING A QUALIFIED ACCOUNT: Use the Qualified Withdrawal Penalty Calculator (use before requesting spreadsheet) and the OPM Comparison Tool (use after getting the spreadsheet).

Request the spreadsheet (Do NOT send to client)

Schedule a meeting with Brook to go over the spreadsheet.

Run the spreadsheet through the software (if desired)

Work with Brook to close the client (use the OPM Agent Portal to track progress).

Get the illustration from Brook

Start the application (50% you, 15% Zach, 35% Kirk)

If with Penn, prepare and send the cover letter.

If the carrier does not order the paramed exam, order the paramed exam.

Fulfill all underwriting requirements until policy is active.

HELPFUL LINKS

STEP-BY-STEP

Before you do anything, set up a profile on the OPM client portal. You may do so here. Once you submit the form, you’ll be required to sign an NDA. Once that’s signed, you should be approved to use the site within a day or so.

If you believe your client is a good candidate for an OPM case, the first thing you’ll do is show them one of the explainer videos, like the one with Maribel using $500,000, or the one that shows how leveraging works.

If they’re interested, download and fill out the Insurance Limits Calculator. That will tell you which is your limiting factor (premium, death benefit, money from qualified funds, etc.) when you are designing your plan.

If they are considering liquidating a qualified plan, and you want so show them a side-by-side of how it compares to leave their money in the 401k v. putting what’s leftover after penalty and taxes into the OPM, use the Qualified Account Withdrawal Penalty Calculator and then run an OPM illustration using the numbers that calculator generates.

Then fill out the Spreadsheet Illustration Request keeping in mind the limits of the calculator. Don’t forget that with the spousal match we can double the premium limits the client would otherwise qualify for. Follow the instructions on the form and make sure you fill out the form completely.

Include the spouse’s information, even if your plan is not to insure the spouse. The case designer is going to take that into account with their plan and may make recommendations using that information.

These spreadsheets are created by real people and take time. We aim to have them to you within a few days, but sometimes it takes up to two weeks to get them back. Take this into account when you speak to your client. You will hear from Brook, brook@uslifepro.com, or one of his associates, when the illustration is ready. If more than ten (10) business days have elapsed and you still don’t have it, please email Brook so she can follow up to make sure we get that for you.

Once you hear from Brook, set up a call to go over the illustration with you prior to having the sales call with your client. You can schedule something with him using this link.

If you are running a comparison to see what the numbers look like when they liquidate their qualified plan, use the OPM Comparison Tool.

If for any reason you need changes to the spreadsheet illustration, DO NOT SUBMIT THE FORM AGAIN. Brook can help you get an updated copy of the spreadsheet. If you submit the form again, it will cause a real human being to have to create the illustration again. It will take longer for you to get back because they’re building it from scratch, not knowing about your original.

Use the OPM Agent Portal to track the progress of your cases.

NOTICE

You can show the client the spreadsheet illustration as part of the sales process if you like. You CANNOT, however, send the client the Excel document without violating the terms of your agreement with us. Do NOT send the client the Excel document. You can show it to them live, via screen share, or even send them screenshots. But the formulas and math in the spreadsheet are proprietary trade secrets and not to be shared.

Brook will be doing the heavy lifting on the sales, but if you think it will be useful, you can use the OPM sales software tool to generate a beautiful PDF that presents the client’s information and plan. You can give the PDF to the client.

Here is a video of the process:

If the client desires to move forward, we will prepare the illustration. You will need to submit the application per the carrier’s application protocols.

Instructions for submitting an application for Penn Mutual, Mass Mutual, or Ameritass, can be found on the applications page.

Application Percentages

When you submit the application, you are going to use these percentages:

Agent, 50%; Zach 15%; Kirk 35%

Penn Mutual Agent Codes:

Zach: Z1Z-1402D

Kirk: N7N-2093E

Mass Mutual Agent Codes:

Zach: AA684000

Kirk:

Ameritas Mutual Agent Codes:

Zach: EN00007029

Kirk:

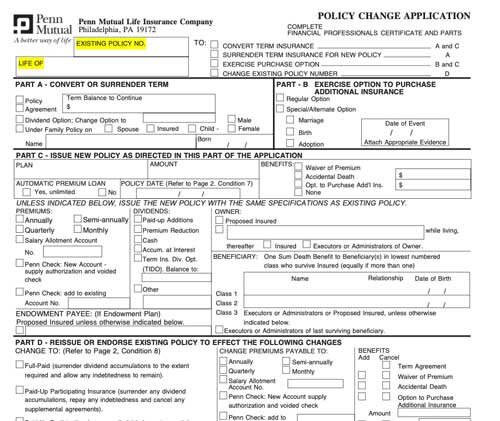

Make sure to check the “APL” (Automatic Premium Loan) box when you submit an application on an OPM case through Penn Mutual. If you have a pre-existing Penn case that does not have the APL selected, fill out the APL Change Form and email it to cs-contractadministration@pennmutual.com.

If you have questions during the process on the Penn cases, you can call Penn Mutual’s application specialists at 866-223-7651.

Once your client’s policy is active, fill out this form to memorialize your client’s policy renewal date.